Government loan programs

FHA loans

An FHA loan is insured by the Federal Housing Administration, a federal agency within the U.S. Department of Housing and Urban Development (HUD). The FHA does not loan money to borrowers, rather, it provides lenders protection through mortgage insurance premiums (MIP) in case the borrower defaults on his or her loan obligations. Available to all buyers, FHA loan programs are designed to help creditworthy low-income and moderate-income families who do not meet requirements for conventional loans.

FHA loan programs are particularly beneficial to those buyers with less available cash. The rates on FHA loans are generally market rates, while down payment requirements are lower than for conventional loans.

Some of the other benefits of FHA financing:

- Only a 3.5 percent down payment is required.

- Closing costs can be paid by seller or gifted from a family member.

- Downpayment can be gifted from a family member

- More flexible underwriting criteria than conventional loans

VA Loans

VA guaranteed loans are made by lenders and guaranteed by the U.S. Department of Veteran Affairs (VA) to eligible veterans for the purchase of a home. The guaranty means the lender is protected against loss if you fail to repay the loan. In most cases, a down payment is not required* on a VA guaranteed loan and the borrower usually receives a lower interest rate than is ordinarily available with other loans. *A down payment is required if the borrower does not have full VA Entitlement, or if the loan amount is greater than $453,100. VA loans subject to individual VA Entitlement amounts and eligibility, qualifying factors such as income, credit standards and property limits.

Other benefits of a VA loan include:

- Closing costs are comparable and sometimes lower - than other financing types.

- No private mortgage insurance requirement.

- Right to prepay loan without penalties

- The Mortgage can be taken over (or assumed) by an eligible VA buyer when a home is sold.

- Counseling and assistance available to veteran borrowers having financial difficulty or facing default on their loan.

Although mortgage insurance is not required, the VA charges a funding fee to issue a guarantee to a lender against borrower default on a mortgage. The fee may be paid in cash by the buyer or seller, or it may be financed in the loan amount.

A VA loan can be used to buy a home, build a home and even improve a home with energy-saving features such as solar or heating/cooling systems, water heaters, insulation, weather-stripping/caulking, storm windows/doors or other energy efficient improvements approved by the lender and VA.

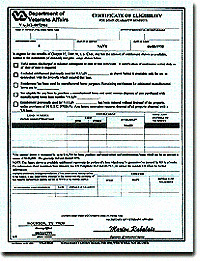

Veterans can apply for a VA loan with any mortgage lender that participates in the VA home loan program. A Certificate of Eligibility from the VA must be presented to the lender to qualify for the loan.

FHA ID 1499301887

VA ID 9601680000